Policy Inclusion for Battery Swapping in India – The Next Big wave

India’s national EV policy FAME II scheme was launched in Apr 2019 with a target to support over 1.5 million EVs through a financial incentive package of INR 10,000 Crores. Till Feb 2020, the scheme supported 14,160 EVs with incentive disbursement of ~INR 50 Crores. DHI has also approved 2,636 charging stations in 62 cities with a support of INR 500 Crores. Over last three years, several players have come up with alternative charging infrastructure technologies/business models such as battery swapping which could potentially accelerate mass adoption of EVs. Battery Swapping approach to charging infrastructure for electric mobility involves usage of small swappable battery(ies) which may or may not be sold along with the electric vehicle (EV). An Energy Operator (EO) sets up mechanism (bulk or distributed) enabling the drained batteries to be charged and swapped (or interchanged) for the EV user.

This approach allows use of a smaller battery in the vehicle enabling it to achieve the desired range by doing multiple quick swaps in a day, thus reducing the overall battery requirement for the fleet. As the raw material for battery pack (Lithium cell or Lithium ore) is 100% imported today, these alternate approaches can significantly reduce the battery import bill and make the system more efficient.

India EV growth will be unique with 80% of its transport mode dominated by 2-Wheelers, 3% by 3-Wheelers and 12-15% by car segments. The 2-Wheeler and 3-Wheeler segments will use smaller battery packs and most attractive for battery swapping. Several players have invested in building technology and business models using this approach, including SUN Mobility, Esmito, Lithion Power, Piaggio, Kinetic, Ola Electric, Bounce, Exicom, Amara Raja Batteries, GrinnTech, NTPC, PGCIL and others. But there is still lack of clarity of regulatory framework and policy support for this technology.

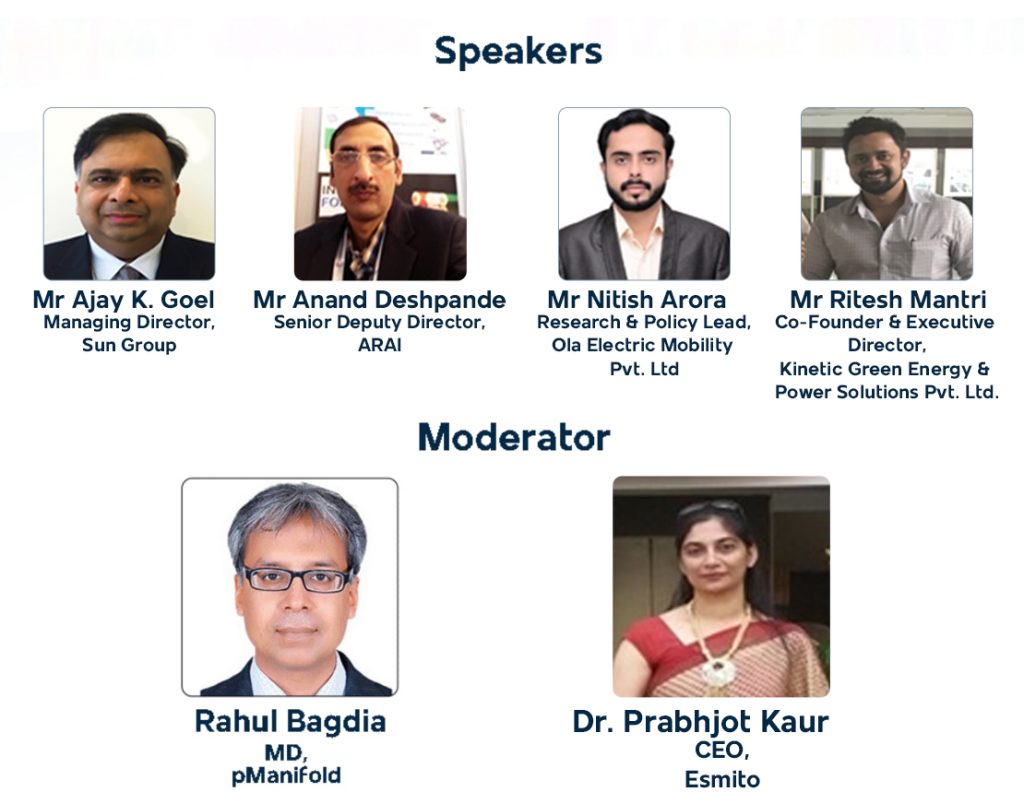

This Webinar will bring experts from multiple domains – Battery Swap Technology Provider, EV OEM, Fleet Operator and EV Testing Agency to discuss following questions:

1. Has battery swapping technology enough proved its techno- commercial feasibility and reliability?

2. If and what standardization is required to build right consensus in OEMs and battery swapping infra providers for hassle free end-use by individuals and fleet operators and scaled up adoption? And at what levels standardization should happen – OEM level, Operator level, National Level?

3. With new amendment by Ministry of Power (dated 8th June, 2020) which has now recognised battery swapping technology, what further next steps and suggestions for its inclusion in various EV policies?