Global Energy Transition: Investment Required and Potential Sources of Financing

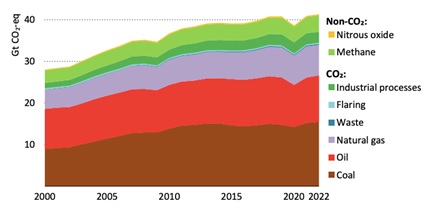

Global energy-related greenhouse gas (GHG) emissions remain a significant threat to the climate due to their due to their magnitude and longevity. As per International Energy Agency (IEA) analysis[1], the total energy emissions increased to an all-time high of 41.3 Gt CO2-eq as shown in Figure 1.

The emissions from energy combustion and industrial processes accounted for nearly 89% of emissions in 2022.Additionally, methane emissions from energy combustion, leaks and venting contributed another10%. These emissions present a stark picture of the climate change situation, as evidenced by recent extreme weather events observed worldwide (e.g., heat waves, floods, droughts, wildfires, etc.).According to the IEA’s World Energy Outlook 2022 analysis[1], global greenhouse gas (GHG) emissions are on track for a significant increase if investments in climate change mitigation are reduced and strict policies are not implemented. The projections indicate that energy related GHG emissions could surpass 55 GtCO2-eqby 2050.

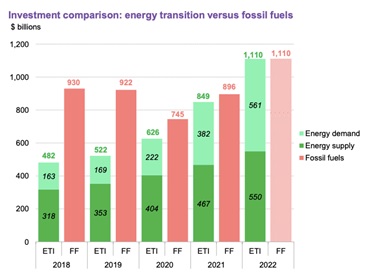

This situation underscores the pressing need for immediate investment in energy transition technologies, encompassing both the supply side (renewable energy, nuclear power, energy storage, hydrogen, etc.) and the demand side (e-mobility, electrified heat, etc.). Historically, countries have predominantly directed significant investments towards fossil fuels to bolster energy security. However, energy transition investments matched fossil fuel investments for the first time in 2022, reaching USD 1.1 trillion, as depicted in theFigure 2. This represents a notable increase of USD 261 billion from the previous year.The shift in investment towards cleanenergy is a historic change that is unlikelyto be reversed, as low-carbon industriescontinue to grow.

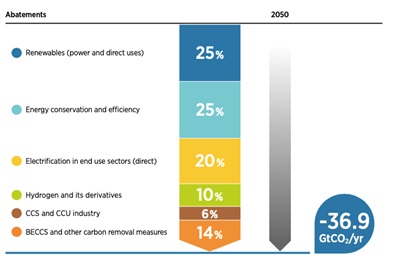

It is important to note that the current investment levels, although encouraging, are insufficient to propel towards the ambitious goals of1.5°C pathway.To set a course on a 1.5°C pathway, the energy transition urgently needs to accelerate; therefore, a holistic, multi-faceted approach is necessary.International Renewable Energy Agency (IRENA) analysis shows that a combination of renewables (both power and end use, electrification and fuels such as hydrogen) and energy efficiency, can provide 80% of the CO2 reductions needed to align the world on a 1.5°C pathway, as shown in Figure 3.To achieve this target, it is estimated that an annual average investment of USD 4.4 trillion will be required, which is equivalent to about 5% of global gross domestic product (GDP).

Potential sources of this funds

Climate finance investments have seen contributions from both public and private sources. Public sources, such as governments themselves; a combination of national Development Financial Institutions (DFIs), multilateral and bilateral DFIs; state-owned financial institutions; and others have played a significant role by providing grants and debt financing. Similarly, private sources, including commercial banks and corporations, have been at the forefront of financing climate-related initiatives. Some of the potential sources are explained below:

- Many governments are establishing the banks as National Development Financial Institutions (DFIs) that focuses on raising and investing fundsacross different industry sectors of the country. This is becoming governments most important financial institution to support and mobilise capital to develop productive investments. Many countries like Germany (kfW), Singapore (DBS), Brazil (BNDES), India (SIDBI), South Africa (DBSA), etc. has their own DFIs established and are promoting and supports the development of innovation, a green economy and sustainable projects.

- Green Bondsare a form of debt instrument and were developed in 2008 in response to growing concern about climate change and sustainability. When an entity issues a green bond, it is essentially borrowing money from investors who purchase the bond. The issuer agrees to pay back the principal amount of the bond along with periodic interest payments over a specified period of time.As of January 2023, green bonds have raised $2.5 trillion globally[1] to support green and sustainable projects.The World Bank, known for issuing the inaugural green bond in 2008, has continued its leadership in this field. To date, they have issued over 200 green bonds in 25 currencies, making significant contributions to the development of sustainable finance. Their efforts have also resulted in the establishment of the Green Bond Principles (GBP), which have emerged as international best practices for transparency and disclosure in the green bond market. [4]Low-cost Finance for the Energy Transition, IRENA 2023

- International financial entities likeGlobal Environment Facility (GEF), Green Climate Fund (GCF), etc.have a primary goal of providing support for global environmental and climate-related projects. These entities place a strong emphasis on country ownership and alignment with national priorities and plans. They support projects and programs that include technical assistance and investments (typically for pilot implementation), which are in line with recipient countries’ national climate strategies and objectives. These funds are intended to mobilize additional resources and leverage investments from various stakeholders within the respective countries. So far, the GEF has disbursed over $22 billion in grants and blended finance, while also mobilizing an additional $120 billion in co-financing for over 5,000 national and regional projects[2]. Likewise, GCF has raised USD 10.3 billion equivalent as of July 2020[3].

- Innovative financing tools such ‘debt-for-climate-swaps’ in which international creditors will agree to reduce debt, either by converting it into local currency, lowering the interest rate, writing off some of the debt, or through a combination of all three. The debtor will then redirect the saved money towards initiatives aimed at increasing climate resilience, lowering GHG emissions or others.

- The expansion of blended finance refers to the increasing use and promotion of innovative financing mechanisms that combine public and private resources to address development challenges and mobilize additional investment. It can play an important role in derisking investments, attracting private capital, etc. to projects and initiatives that contribute to sustainable development.Public resources alone are often insufficient to address the vast financing needs required for sustainable development. By blending public and private resources, governments, development finance institutions, and other stakeholders can leverage the strengths of both sectors.

The above discussion highlights the importance of investments in energy transition technologies. Countries need to not only increase their own investments but also facilitate greater financing in developing and emerging economies. It is essential to recognize that relying on just a few financing solutions will not be sufficient. Instead, countries must explore multiple financing options to create economies of scale for emerging energy transition technologies.

[6]GEF funds

[7]GCF Funds