Impact of Net-Metering Policy on Solar Roof Top project parameters for Residential Consumers of Tamil Nadu, Andhra Pradesh & Karnataka

There has been a continuous and growing interest for grid connected solar rooftops across India. This is primarily due to shift in consumer behaviour across all consumer categories (residential, industrial, commercial, etc.). The consumer is not just interested in consuming electricity but also producing it. By installing solar in their own premise, they can now produce and save on electricity bills. This prosumer behaviour is expected to rise further and attract more interest and investment on solar rooftop models.

Each state has its own load profile and installation capacity. Hence, to match up the industry trend, ensure grid stability, reduce environmental impact and power companies’ losses, the solar rooftop policy varies from state to state. In general, we cannot say which state has a best solar rooftop net metering policy as there are several factors which need to be considered while making a comparison.

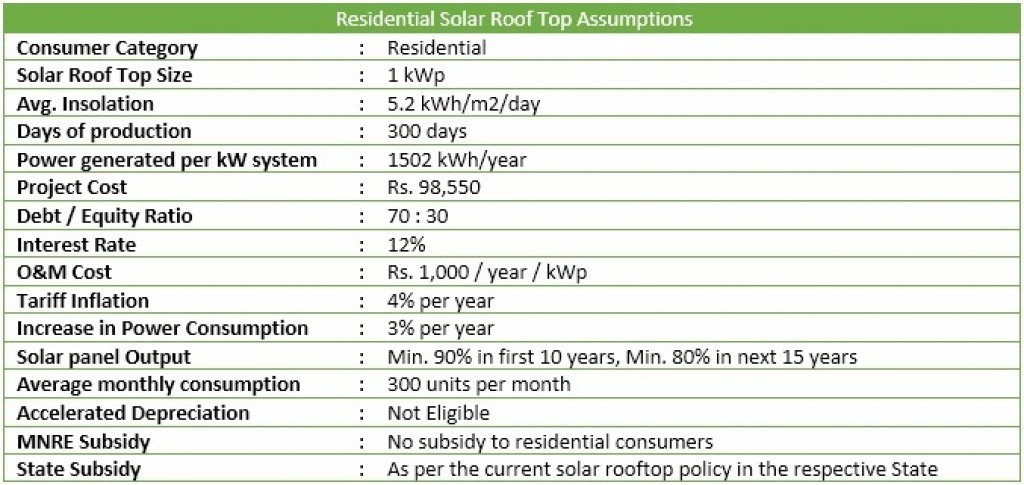

In this blog, we have compared the solar rooftop policy of three states for residential consumers: Tamil Nadu, Andhra Pradesh, and Karnataka. The key assumptions considered for comparison are mentioned below,

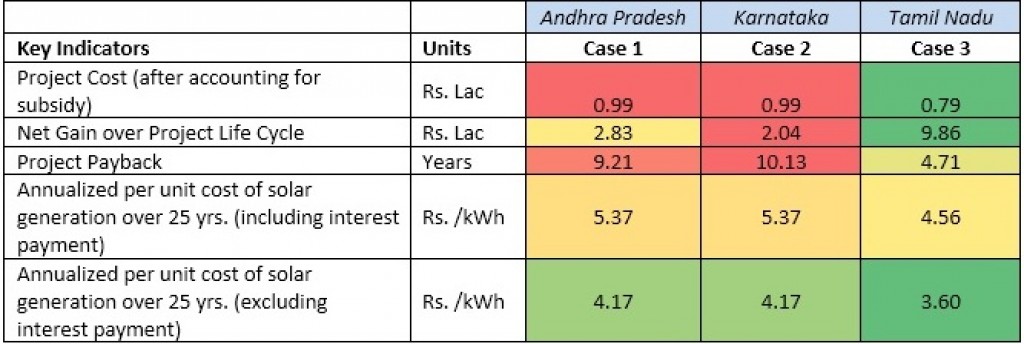

The simulation result of above parameters for three states is shown below,

Conclusion:

- In residential solar rooftop with the 1kW system, Tamil Nadu has a favourable policy (payback less than 5 years) among the three states because of the subsidy provided by state government.

- For given power consumption level, the bill saving due of Andhra Pradesh consumer is higher than Karnataka. This is mainly due to the tariff slab difference between the two states.

Scenario Analysis 1: Average Monthly Consumption Vs Payback Period (In years)

Higher the monthly units consumed, higher the power tariff and hence the electricity bill. Therefore, every solar unit generated will deduct one unit from higher power tariff slab. Below is the scenario analysis performed to check the impact on payback period by changing the input parameter ‘monthly consumption’ and keeping other parameters same.

Conclusion: The payback period is dependent on consumer tariff slab, monthly power consumption, and solar generation capacity.

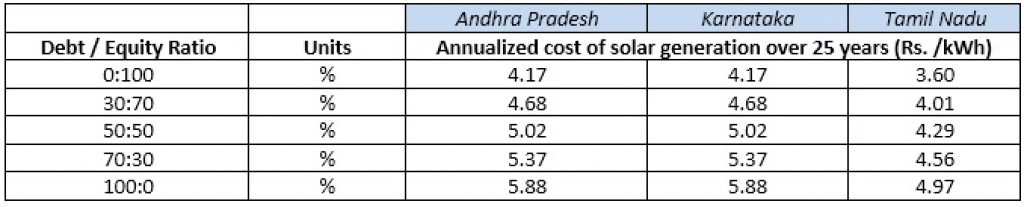

Scenario Analysis 2: Debt Equity Ratio Vs Annualized cost of solar generation over 25 years

Below table summarizes the impact of interest rate and debt portion on annualized cost of solar generation over 25 years.

Conclusion: The debt portion has a significant impact on annualized per unit cost of generation. The cost per unit may go up to 42% higher when compared with no debt situation.

Overall Remarks

In general, the payback period for 1kW solar rooftop system is 10 to 15 years without subsidy. Keeping in mind, MNRE priority on residential buildings is lower and high payback period, the adoption of grid connected solar rooftop may take more time to unlock the potential residential category promises. Hence, state government needs to step forward to provide financial assistance to meet their renewable targets by 2022.

Similar kind of analysis can also be extended to compare the solar rooftop policy for other consumer categories (commercial, industrial, etc.). In such case, the benefits like a central subsidy, 80% accelerated depreciation, MAT credits, etc. also needs to be properly accounted to determine the solar project feasibility and tax liabilities for project developers.